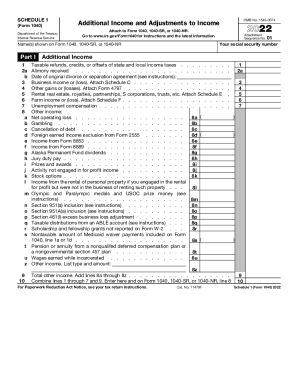

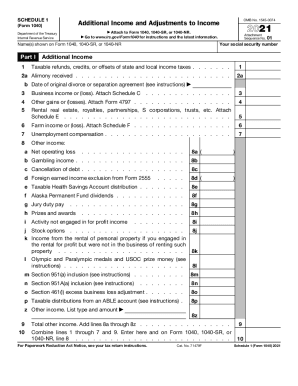

Irs Form 1040 Schedule 1 2024 Form

Irs Form 1040 Schedule 1 2024 Form – must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity,” the IRS publication 525 states. In case of stolen property, . If your state or local government requires you to collect sales tax, you only need to report lump sum amounts on Schedule C. Form 1040, Schedule C, Line 1 Report all money you collected in your .

Irs Form 1040 Schedule 1 2024 Form

Source : turbotax.intuit.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.gov1040SCHED1 Form 1040 Schedule 1 Additional Income and

Source : www.greatland.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov1040SCHED1 Form 1040 Schedule 1 Additional Income and

Source : www.nelcosolutions.comIrs Form 1040 Schedule 1 2024 Form What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos: Even though we’re well into February, it’s still possible that you might not have your W-2 yet. Here’s what to do. . New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024. .

]]>

.png)

.png)

.png)