Can You Deduct Home Office In 2024 Year

Can You Deduct Home Office In 2024 Year – If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. .

Can You Deduct Home Office In 2024 Year

Source : www.cnbc.comHome Office Deduction for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.com2024 Tax Tips: Home office deduction

Source : www.cnbc.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.comHow Working from Home Affects Income Taxes & Deductions (2023 2024)

Source : www.debt.org25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comMaximizing Home Office Deduction (2024) | myCPE

Source : my-cpe.comHome Office Deductions for 2024 | Alloy Silverstein YouTube

Source : www.youtube.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.com5 Tax Traps for Claiming a Home Office Deduction Barbara Weltman

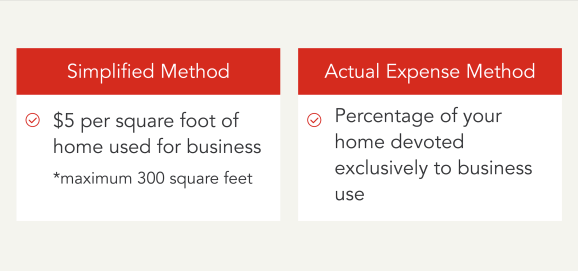

Source : bigideasforsmallbusiness.comCan You Deduct Home Office In 2024 Year 2024 Tax Tips: Home office deduction: The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . With the 2024 tax season in full swing — the IRS has already received over 25 million returns — getting your tax return submitted is probably on your mind. And if you plan to file soon, make sure to .

]]>